From Confused to Confident: Mastering Tax Brackets

Understanding the U.S. tax brackets is essential for effective financial planning and ensuring you’re not overpaying come tax season.

The Internal Revenue Service (IRS) updates tax brackets annually to reflect inflation and other economic considerations. This guide will break down the 2023 U.S. tax brackets, explain how they impact your income, and offer strategies to minimize your tax liability.

What Are Tax Brackets?

Tax brackets are ranges of income taxed at specific rates. This is the foundation of the progressive tax system. Under this system, as your income increases, it is taxed at higher rates.

It’s a common misconception that all your income is taxed at the rate of your highest bracket. Instead, income is taxed across different rates, corresponding to each bracket it falls into, ensuring a fairer taxation process.

This structure is a cornerstone of the federal income tax system, designed to ensure that individuals with higher incomes contribute a proportionately larger share to the government’s revenues.

Understanding Tax Brackets

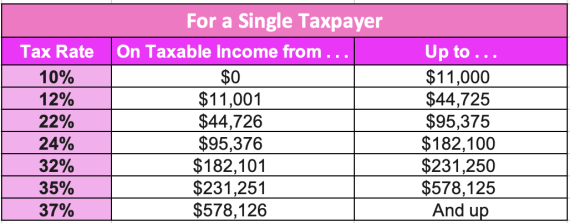

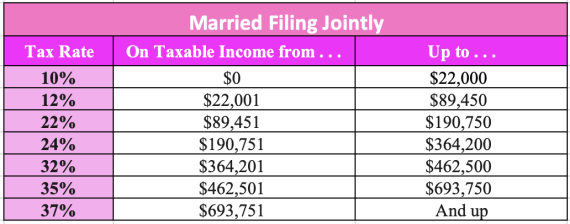

For the 2023 tax year, the IRS has adjusted the tax brackets to account for inflation. These adjustments prevent taxpayers from being pushed into higher tax brackets because of cost-of-living increases. Here’s an overview of the tax brackets for single filers and married couples filing jointly:

Strategies to Minimize Tax Liability

There are a number of investments you can make to lower your taxable income and thus your tax rate. Below are some of the most common.

1. Maximize Retirement Contributions:

Contributing to tax-advantaged retirement accounts like a 401(k) (generally an employer-sponsored retirement account) or an IRA (Individual Retirement Account) can reduce your taxable income. For 2024, you can contribute up to $23,000 pre-tax dollars towards your 401(k) and $7,000 re-tax dollars towards your IRA.

So what does this mean?

Let’s say you’re a single filer, making a $50,000 annual salary:

- $11,000 is taxed at 10%, meaning you’ll pay $1,110 towards federal taxes for this portion of your salary.

- The next portion of your income $11,001-$44,725 ($33,724) is taxed at 12%, meaning you’ll pay $4,047 towards federal taxes for this portion of your salary.

- The last portion of your income $44,726-$50,000 ($5,274) is taxed at 22%, meaning you’ll pay $1,160 towards federal taxes.

Now let’s say you invested $105 dollars weekly into your 401K, by the end of the year you would have invested $5,460. This means that you wouldn’t have to pay any taxes on the $5,274 that would have been taxed at 22%. Hello $1,160 savings! Note that you will have to pay taxes on this money when you take it out. But because 401Ks are retirement accounts that you should not withdraw from until you’re 59.5 years old, this money would have had significant amount of time to grow and your tax bracket is likely to be lower when you retire.

2. Leverage Tax Deductions and Credits:

Familiarize yourself with deductions and credits that apply to your situation. Itemizing deductions can be beneficial if they exceed the standard deduction.

3. Health Savings Accounts (HSAs):

If you have a high-deductible health plan, contributing to an HSA can lower your taxable income. HSAs offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

4. Invest in Education:

The IRS offers several tax benefits for education, such as the American Opportunity Tax Credit and the Lifetime Learning Credit, which can help reduce your tax bill if you’re paying for college or continuing education.

5. Investing in 529 Plans:

Investing for a child’s college education via a 529 college savings plan can also give you tax breaks.

Conclusion

Navigating the U.S. tax brackets requires a strategic approach to minimize your tax liability while maximizing your financial health. Understand how your income is taxed and you’ll be able to lower your tax bill and increase your savings. Always consider consulting a tax professional to ensure you’re making the most of your financial planning and following the latest IRS guidelines.

Staying informed and proactive about your taxes can significantly benefit your financial well-being, allowing for smarter investment decisions and long-term planning.